|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxi Breakdown Insurance: A Comprehensive Coverage GuideAs a taxi driver in the U.S., ensuring your vehicle is protected against unexpected breakdowns is crucial. Taxi breakdown insurance provides peace of mind and financial protection, covering repair costs and offering extended auto warranty options. This guide explores what you need to know about taxi breakdown insurance, highlighting the benefits and coverage specifics. Understanding Taxi Breakdown InsuranceTaxi breakdown insurance is designed to cover the costs associated with vehicle failures. It ensures that drivers can get back on the road quickly without incurring significant out-of-pocket expenses. Here’s why it matters:

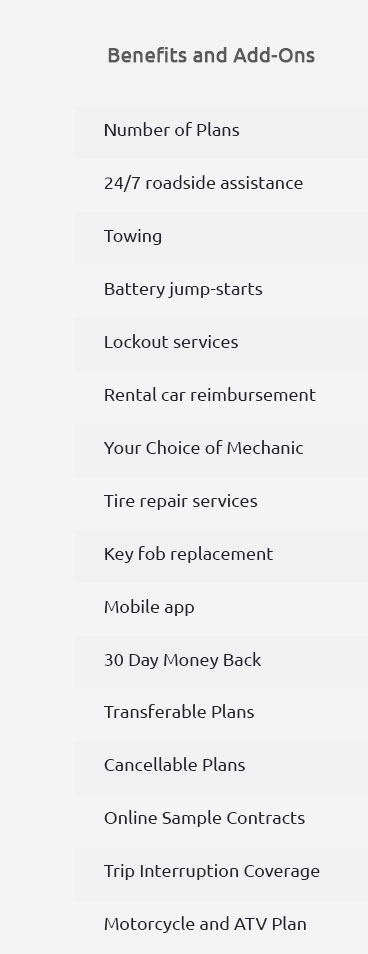

What’s Covered in Taxi Breakdown Insurance?Coverage can vary, but generally, taxi breakdown insurance includes: Vehicle Repair CostsRepairs for mechanical and electrical failures are typically covered, ensuring your taxi is back in service swiftly. This can include parts and labor for engine, transmission, and other critical components. Towing ServicesIf your taxi breaks down on the road, towing to the nearest repair shop is usually included. Additional BenefitsMany policies offer extras like rental car coverage while your taxi is being repaired. This ensures you can continue earning despite vehicle downtime. Extended Auto Warranty OptionsExtended warranties offer additional protection beyond standard coverage. For more detailed insights, visit this seat extended warranty review to explore different options available to you. Cost ConsiderationsCosts for taxi breakdown insurance vary based on several factors:

To compare extended warranty plans, you might find the 1st automotive extended warranty insightful for broader coverage options. FAQs About Taxi Breakdown InsuranceWhat is the average cost of taxi breakdown insurance in the U.S.?Costs can range from $300 to $1,000 annually, depending on factors such as vehicle type, age, and location. Are rental cars covered while my taxi is repaired?Yes, many policies offer rental car coverage to ensure you can continue working while your taxi is being repaired. Does taxi breakdown insurance cover towing services?Most policies include towing to the nearest repair facility as part of the coverage. In summary, taxi breakdown insurance is a valuable investment for U.S. taxi drivers. It not only offers financial protection but also provides peace of mind, ensuring that you remain on the road and continue to earn, even in the face of unexpected breakdowns. https://insurd.co.uk/blog/what-is-taxi-breakdown-cover/

Taxi breakdown cover is a specialised form of breakdown insurance designed specifically for vehicles used as taxis or private hire vehicles. https://dylan-davies-f504.squarespace.com/s/IPID-Taxi-breakdown-90-days-National-cover-v11.pdf

Up to one hour's labour for assistance at your home or at the roadside if your taxi is immobilised or rendered unroadworthy as the result of an insured ... https://www.insuretaxi.com/breakdown/

You can be protected against both mechanical and electrical breakdowns, which is handy if you're in a shiny, new electric taxi.

|